2024 Banking and Finance Webinar Report: Insights with Infographic

Download the 2024 Finance and Banking Webinar Report

As the banking and finance sector embraces digital transformation, webinars have emerged as a crucial tool for engagement, education, and brand building.

These online events allow institutions to reach a broader audience, share valuable insights, and establish thought leadership in a competitive market.

In our 2024 Banking and Finance Webinar Benchmark, we dive deep into the key trends and data that reveal how organizations in this sector can maximize the effectiveness of their webinars, from content strategies to audience interaction and beyond.

Key Takeaways

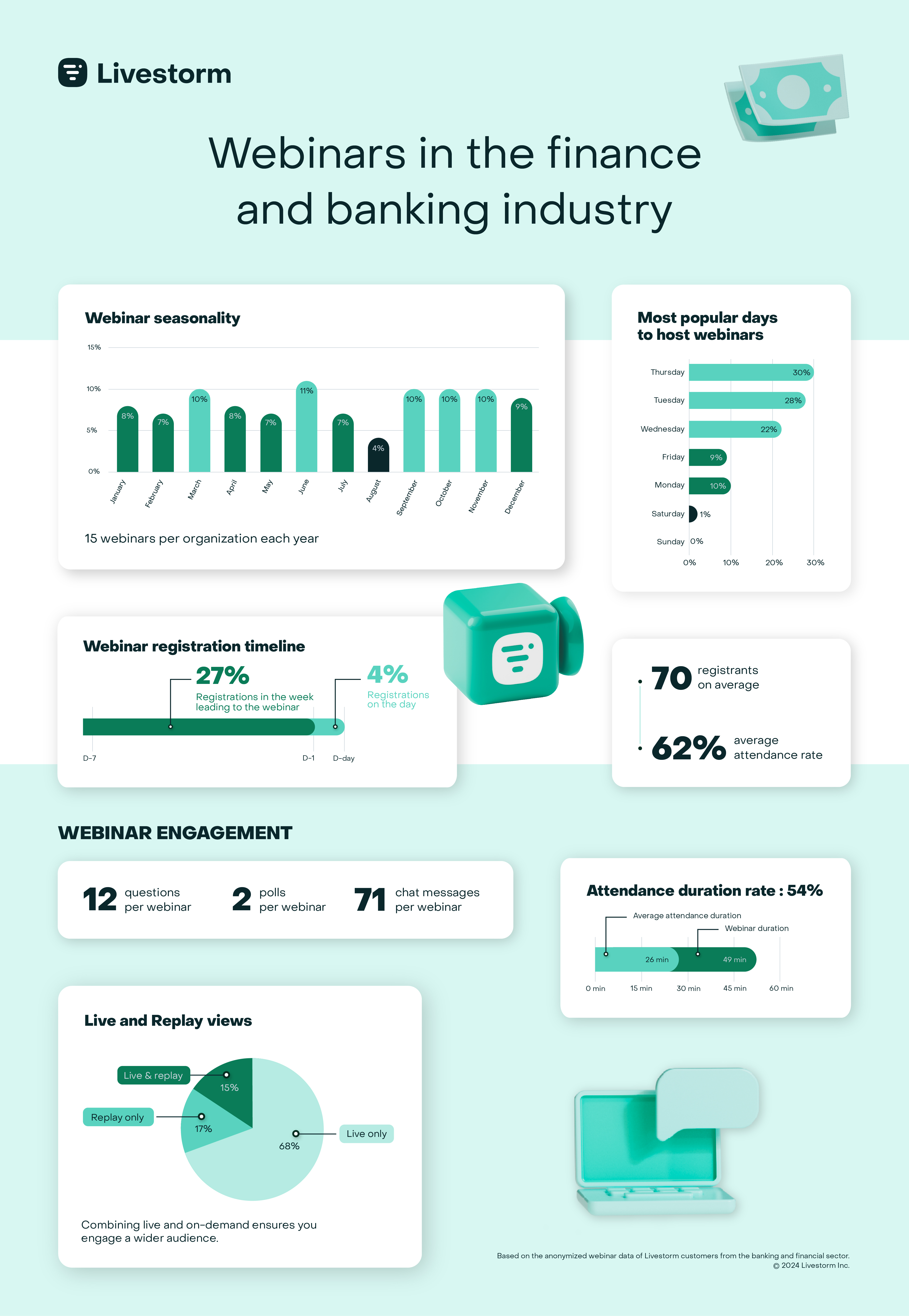

An average of 15 webinars are hosted annually in finance, surpassing other industries by 7%, with June accounting for 11% of yearly events.

Tuesday is the preferred day for banking webinars, with Thursday and a rising trend for Friday, positively affecting engagement rates.

32% of registrations occur within the final week before events, indicating the impact of late-stage promotional activities on attendance.

Average webinar registrant numbers dropped from 70 in 2023 to 62 in 2024, but attendance rates remain high at 59%.

While live session preference remains at 72%, chat activity has increased; opportunities exist to further boost interactivity via polls and questions.

Elevate your webinars with Livestorm's Finance and Banking Webinar Report. Uncover key insights and benchmark your performance among industry peers.

Webinar Frequency in Banking & Finance

Financial sector organizations hosted an average of 15 webinars annually, surpassing other industries by 7%. These financial webinars cover topics like regulatory updates and investment strategies, offering valuable insights to professionals and clients.

Financial sector organizations hosted an average of 15 webinars annually

The second half of the year, being heavier for webinars in the industry, we expect a surge in the total number of webinars compared to 2023. This increase is driven by a focus on marketing and communications after the summer holidays.

The goal is to re-engage audiences and provide timely financial content to navigate the ever-evolving financial landscape.

Seasonality: Timing is Everything

June is the busiest month for webinars, making up 11% of the yearly total. This spike is due to annual accounts closing and investor presentations early in the year, which drive strategic planning and adjustments.

June is the busiest month for webinars, making up 11% of the yearly total.

Following these events, there's a significant increase in marketing efforts in the second half of the year, leveraging the insights gained. Other high-traffic months include March, September, October, and November.

These months align with quarterly reviews, product launches, and pre-holiday campaigns. This predictable cycle helps streamline webinar scheduling throughout the year, ensuring businesses can plan effectively for maximum engagement.

Elevate your webinars with Livestorm's Finance and Banking Webinar Report. Uncover key insights and benchmark your performance among industry peers.

Choosing the Best Day for Webinars in the Financial Sector

When selecting the best day to host a webinar, the financial sector shows a clear preference for Tuesdays, closely followed by Thursdays.

These days see higher attendance rates and better participant engagement. Interestingly, Fridays are becoming more popular, with 13% of webinars now held on this day, up from 10% in 2023. This indicates a shift in scheduling preferences.

In other industries, Thursday remains the most popular day for webinars. This day balances the mid-week lull with the anticipation of the weekend, making it an optimal time for audience participation.

Selecting the best day for your webinar can significantly impact your attendance and engagement rates. Consider these trends when planning your next online event.

Webinar Engagement Metrics in Finance

Registration Trends

The webinar metrics show that most banking and finance webinar registrations (32%) happen within the week before the event, emphasizing the importance of last-minute promotions.

This trend shows that potential attendees often decide closer to the event date, possibly considering their schedules or the webinar's relevance.

In 2024, there's been a slight drop in the average number of registrants per webinar in the banking and finance sector, decreasing from 70 in 2023 to 62 in 2024.

In 2024, there's been a slight drop in the average number of registrants [...] decreasing from 70 in 2023 to 62 in 2024.

Despite this decline, the banking and finance industry continues to lead in registrant volume.

This indicates strong ongoing interest and engagement in financial topics and professional development opportunities within the sector.

Attendance and Engagement

The average attendance rate for banking and finance webinars remains impressively strong at 59% in 2024, a notable increase from the 48% attendance rate seen in other sectors.

This indicates a sustained interest and commitment from finance professionals to stay informed and updated through virtual events.

Attendance duration is also progressing, with attendees staying for an average of 28 minutes, up slightly from 26 minutes in 2023.

While the financial sector leads in webinar attendance rates, it lags in interactivity. On average, only two polls are shared per webinar, compared to three in other industries.

This suggests an opportunity to increase interactive elements to further engage participants.

The sector sees fewer live questions and polls during webinars, which might suggest a more passive consumption of content.

Despite this, chat engagement has improved, with 24 more messages posted per webinar in 2024 compared to previous years.

This increase in chat activity highlights a growing trend toward real-time communication and discussion among attendees, even if other forms of interactivity remain lower.

In summary, banking and finance webinars continue to attract high attendance rates, reflecting the industry's commitment to staying updated.

However, there's room for improvement in interactivity to enhance participant engagement.

Maximizing Post-Webinar Engagement

Providing on-demand content is crucial for maximizing audience engagement.

In 2024, data revealed that 72% of attendees preferred live sessions, 14% watched both live and replay, and 13% chose the replay only.

This shows a significant audience segment values the flexibility of on-demand content. By including replay options, you can capture additional viewers who might miss the live event, thus expanding your reach and enhancing audience interaction and engagement.

Ensure your content strategy includes live streaming, replays, and on-demand options to cater to diverse audience preferences and boost engagement.

Key Takeaways for Financial Webinars

- Prioritize Timing: June is a peak month for webinars in finance, making it essential to plan well ahead. March, September, and October are also high-traffic months.

- Focus on Last-Minute Promotions: With 32% of registrations happening in the final week, make sure to ramp up promotional efforts close to the event date.

- Increase Engagement: While attendance rates are high, there's room to improve interactivity through live polls, Q&A, and chats to keep audiences engaged longer.

- Leverage On-Demand Content: Replay options extend the life of your webinar, allowing you to engage a broader audience beyond the live event.

The Future of Financial Webinars

The future of the banking and finance sector looks promising with the adoption of advanced technologies like AI-driven personalization and immersive interactive experiences.

Webinar Finance and Banking Infographic